Comprehending the Structure: What is a Gold individual retirement account?

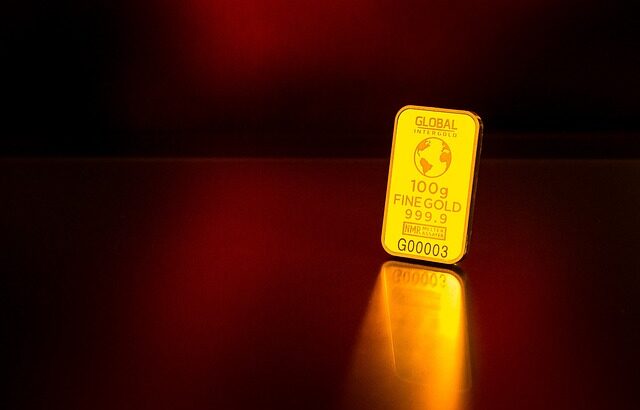

Before diving right into techniques, it’s important to realize the basics of a Gold IRA. Unlike conventional Individual retirement accounts that primarily acquire bonds, stocks, and mutual funds, a Gold individual retirement account allows individuals to allocate a section of their retirement life financial savings into physical gold or other rare-earth elements. This Orlando Magazine diversification can hedge against increasing price of living, money devaluation, and market volatility, making it an attractive option for those seeking security in their investment profile.

Method 1: Create Clear Financial Investment Goals

The initial step in building a wide variety securely with a Gold individual retirement account is developing clear economic investment purposes. Whether your objective is wide-range conservation, source acknowledgment, or profile diversity, specifying your goals will help form your investment technique. Consider your risk resistance, time perspective, and desired degree of direct exposure to rare-earth elements when describing your monetary investment objectives.

Method 2: Conduct Thorough Study

An informed capitalist is a certain investor. Make an initiative to study, research study, and identify the dynamics of the gold market, consisting of elements affecting costs, supply and require trends, and geopolitical risks. Stay updated on financial signs and global events that might affect the worth of gold. By remaining educated, you can make educated options concerning your Gold individual retirement account financial investments.

Method 3: Team Up With a Reputable Custodian

Picking the right custodian is extremely important to the success of your Gold IRA approach. Find a relied-on custodian with a performance history of integrity, security, safety, and customer satisfaction. Ensure that the custodian is fluent in IRS legislation controlling Gold IRAs and can assist throughout the financial investment procedure. A relied-on custodian will aid in securing your belongings and ensure consistency with IRS standards.

Method 4: Increase Your Profile

While gold can function as a trustworthy property in economic unpredictability, maintaining a different profile is required to minimize threats. Consider assigning several of your Gold individual retirement account funds to other buildings such as silver, platinum, or palladium to spread risk throughout different belongings training courses. Diversity can boost profile longevity and reduced susceptability to market adjustments.

Method 5: Take a Long-Term Point Of View

Structure wide variety securely with a Gold individual retirement account needs a lasting point of view. While short-term rate adjustments are unpreventable, focus on the standard worth of gold as a shop of wealth gradually. Refrain from catching market hype or attempting to time the market, as this can result in spontaneous decisions and threaten your financial investment objectives. Rather, be self-disciplined and stay committed to your resilient financial investment method.

The Situation for Gold: Safety And Security and Long-Term Growth

Gold has long been considered a store of value and a bush against the climbing price of living. Its inherent domestic or industrial residential or commercial properties make it immune to corrosion, tarnishing, and disintegration, ensuring its long-lasting worth. Unlike fiat money, which can be based upon a decline due to monetary instability or federal government policies, gold maintains its purchasing power and value over the long term.

Economic Changeability and Market Volatility

In today’s uncertain financial landscape, noted by market volatility, geopolitical stress, and anxiety, sponsors seek a place in residential or commercial properties that provide security, security, and protection. With its proven performance history as a haven ownership, Gold gives a feeling of satisfaction amid bumpy rides. Whether geopolitical problems, money adjustments, or economic situations, gold has typically worked as a dependable shop of treasures, using defense against systemic risks.

The Obligation of Gold in Profile Safety And Security

Gold has long been considered a safe haven, enduring its worth during financial recessions and geopolitical situations. Its upside-down relationship with other property courses, particularly stocks, uses a crucial barrier versus market turbulence. When supply prices plunge, gold usually experiences an uptick in demand, functioning as a bush against losses and supporting complete profile effectiveness.

Advantages of Integrating Gold IRA in Your Account

1. Diversity: A Gold individual retirement account uses unparalleled advantages, lowering your retirement portfolio’s total hazard of straight exposure. You generate a robust defense reaction versus market changes by designating several residential or commercial properties to physical gold.

2. Wide Variety Preservation: Gold has shown its capability to preserve buying power with time. Unlike fiat money, prone to inflationary pressures, gold preserves its worth, making it an exceptional truck for lasting wide-range preservation.

3. Risk Decrease: In times of financial uncertainty or recession, the safety and security of gold acts as a trusted support for financiers. Including a Gold IRA in your profile relieves the threat of significant capital disintegration throughout rough market problems.

4. Portfolio Insurance Policy: Think About a Gold individual retirement account as an insurance plan for your retired life cost financial savings. While typical properties might experience volatility and decrease, gold is credible insurance policy protection against the fragmentation of your acquiring power and retired life nest egg.

Exactly Exactly How to Develop a Gold Individual Retirement Account

Developing a Gold IRA is a simple treatment that starts with selecting a respectable custodian specializing in rare-earth elements pension plan. When you have chosen a custodian, you’ll fund your account and deal with them to buy IRS-approved gold bullion or coins to be held in your pension.

Conducting a total research study and due diligence when selecting a custodian to ensure they comply with regulatory needs and provide risk-free storage alternatives for your rare-earth elements holdings is necessary.

Conclusion

In an age noted by financial changability and market volatility, guarding your retired life monetary cost savings is incredibly important. A Gold individual retirement account is a peace of mind, providing security, diversity, and long-term development capability to your monetary investment profile. By integrating physical gold into your retirement method, you strengthen your financial future and gain convenience, recognizing that your riches are protected from the uncertain tides of the marketplace. Welcome the power of a Gold individual retirement account today and embark on a trip towards a lot more safe and successful.