Exactly how to Transfer Your 401( k) to a Gold Individual Retirement Account: A Comprehensive Overview

In the world of retirement planning, expanding your investment portfolio is critical for securing your monetary future. Diversification not only lowers threat but also improves the capacity for lasting growth. Among the different diversity techniques, transferring your 401( k) to a gold IRA has obtained substantial grip in recent times. How to transfer 401k to gold IRA rollover

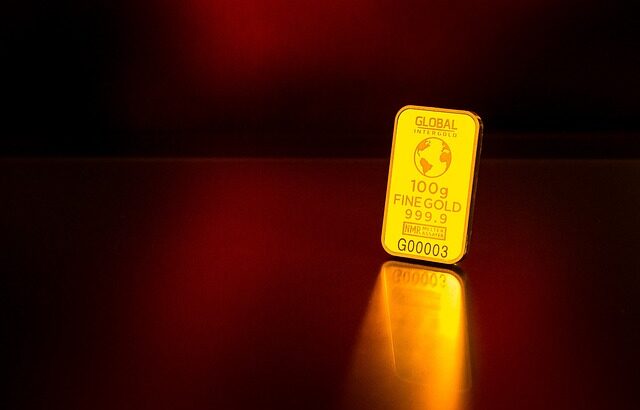

Gold, a rare-earth element with an abundant background of value preservation, has actually emerged as a prominent option for investors looking for defense versus rising cost of living and market volatility. As a concrete property with inherent worth, gold provides a complacency compared to paper-based investments.

Why Transfer Your 401( k) to a Gold IRA?

Several engaging factors exist for considering a 401( k) to gold IRA rollover:

- Diversification: A gold IRA gives a bush against rising cost of living and financial recessions, expanding your profile past traditional investments.

- Concrete Asset: Gold’s physical nature offers a sense of security and stability compared to paper-based possessions.

- Potential for Development: Gold has historically shown the capacity for lasting growth, making it an appealing enhancement to a varied retirement profile.

- Tax Benefits: Moving over funds from a 401( k) to a gold IRA is a tax-advantaged purchase, permitting you to postpone taxes up until withdrawal.

- Retirement Defense: Gold can function as a beneficial secure versus monetary instability, protecting your retired life savings from market variations.

Steps to Transfer Your 401( k) to a Gold individual retirement account

The procedure of moving your 401( k) to a gold IRA is relatively uncomplicated and can be finished in a few simple steps:

Select a Reliable Gold Individual Retirement Account Custodian: Select a trustworthy gold IRA custodian that abides by IRS laws and offers protected storage space centers for your physical gold bullion.

Open a Gold Individual Retirement Account Account: Establish a gold IRA account with the picked custodian. This includes supplying personal details, finishing essential paperwork, and funding the account with eligible rollover funds.

Launch Rollover from 401( k): Call your current 401( k) plan administrator and demand a direct rollover of funds to your brand-new gold IRA account. Give the necessary account details, including the custodian’s name and directing details.

Select Gold Bullion: Once the rollover is complete, you can start choosing physical gold bullion to acquire and hold in your gold IRA account. Choose from a variety of gold bars, coins, and rounds, guaranteeing they meet IRS qualification demands.

Considerations Prior To Transferring

Before embarking on a 401( k) to gold individual retirement account rollover, carefully take into consideration the list below aspects:

Financial Investment Goals: Evaluate whether gold lines up with your overall financial investment goals and take the chance of tolerance.

Liquidity: Gold is much less fluid than standard financial investments, needing more time and effort to sell.

Charges: Understand the charges connected with gold Individual retirement accounts, including storage space and transaction prices.

Specialist Advice: Consult a financial consultant to review the viability of a gold individual retirement account for your specific circumstances.

Recognizing the Different Gold IRA Rollover Options

When moving your 401( k) to a gold individual retirement account, you have two key alternatives to think about: direct rollover and indirect rollover. Each technique has its own benefits and negative aspects, making it crucial to recognize the nuances prior to making a decision.

- Direct Rollover:

In a straight rollover, funds are moved directly from your 401( k) strategy to your gold IRA account without ever before touching your hands. This approach reduces the threat of incurring tax obligations or fines and guarantees a smooth change of funds.

Benefits:

Removes the danger of very early withdrawal fines

Streamlines the rollover procedure

Makes sure tax-deferred treatment of funds

Negative aspects:

May not be offered for all 401( k) plans

Calls for sychronisation in between your strategy manager and gold individual retirement account custodian

- Indirect Rollover

An indirect rollover includes taking out funds from your 401( k) plan and depositing them into your gold IRA account within 60 days. This technique provides extra flexibility however comes with the potential for tax implications.

Benefits:

Supplies even more control over the timing of the rollover

Permits debt consolidation of funds from multiple 401( k) strategies

Downsides:

May sustain very early withdrawal charges if you are under 59.5 years of ages

Needs you to take care of the funds straight, raising tax risks

Choosing the Right Rollover Method

The option between a straight and indirect rollover relies on your particular conditions and risk tolerance. If you prioritize tax obligation efficiency and desire a hands-off method, a direct rollover is typically suggested. Nevertheless, if you have multiple 401( k) plans or like more control over the timing, an indirect rollover might be better.

Speak with your economic expert to identify one of the most proper rollover technique for your situation. They can evaluate your specific circumstances, tax obligation implications, and risk profile to guide you in the direction of the very best choice.

Maximizing Your Gold Individual Retirement Account Rollover

To optimize your gold individual retirement account rollover experience, take into consideration these important suggestions:

- Conduct Thorough Research Study: Pick a trustworthy gold individual retirement account custodian with a proven performance history and transparent fees.

- Understand Qualification Needs: Ensure the gold bullion you select satisfies IRS eligibility standards for gold Individual retirement accounts

- Look For Specialist Guidance: Speak with an economic expert to examine your financial investment objectives, threat resistance, and overall monetary plan.

- Think About Storage Options: Determine whether to keep your gold bullion at home or make use of the custodian’s safe and secure storage space centers.

- Keep Informed: Follow modifications in IRS policies and market conditions that may affect your gold individual retirement account.

By following these standards, you can approach your gold IRA rollover with confidence and make notified choices that might align with your long-lasting financial objectives.

Navigating the Regulative Landscape of Gold IRAs.

The globe of gold IRAs is governed by specific policies stated by the Internal Revenue Service (INTERNAL REVENUE SERVICE) to ensure conformity and safeguard investors. Understanding these policies is crucial for avoiding potential tax penalties and making sure the correct administration of your gold individual retirement account.

Trick Internal Revenue Service Regulations for Gold IRAs

Qualified Gold Bullion: Just particular forms of gold bullion fulfill internal revenue service qualification demands for gold Individual retirement accounts. These consist of gold bars, coins, and rounds with a purity of a minimum of 99.5%.

Storage Space Demands: Gold bullion kept in a gold IRA must be kept on a IRS-approved vault. This ensures the protected and verifiable safekeeping of your precious metals.

Prohibited Deals: Particular transactions remain in restricted within a gold individual retirement account, such as borrowing versus your gold or utilizing it as collateral for a finance.

Circulation Regulations: Withdrawals from a gold IRA undergo certain regulations and might sustain tax obligations and penalties.

Reporting Requirements: You are in charge of reporting gold IRA purchases on your annual tax return.

Tax Effects of Gold IRAs

Gold IRAs offer tax-deferred therapy, indicating you delay paying tax obligations on your investment gains up until you start taking withdrawals. Nonetheless, withdrawals from a gold individual retirement account prior to you get to age 59.5 might incur very early withdrawal fines.

Look For Expert Guidance on Tax Implications

Given the intricacies of tax regulations and the one-of-a-kind characteristics of gold Individual retirement accounts, it’s highly advised to get in touch with a tax expert to guarantee you abide by all applicable laws and minimize your tax obligation responsibility.

Final thought

Transferring your 401(k) to a gold individual retirement account offers a compelling opportunity to expand your retired life portfolio and possibly improve your long-lasting economic security. By incorporating gold, a tangible possession with an abundant background and enduring worth, you can guard your cost savings versus market variations and accept the capacity for growth.

Remember to perform detailed research, recognize the connected risks and costs, and look for professional guidance if necessary. With cautious consideration and notified decision-making, a 401(k) to gold individual retirement account rollover can empower you to take control of your retirement future.